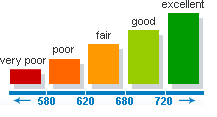

We all need credit for something and no one seems to have all the details on how to preserve good FICO sores or to build them. It becomes confusing to try to figure it all out. Do you get a new card and run up the credit - will that improve your credit score? How about if you apply for a bunch of new cards so you have high credit limits? Allof the anwers seem to be the same: it deptends. But there are some general rules of thumb you can follow to make creidt more fun instead just another source of confusion and frustration. It all seems to be about the almight FICO score.

Your credit score is often referred to as your FICO score. It stands for Fair Isaac’s Corporation and isn’t really the only score out there – but for the sake of this article, we’ll refer to the FICO score. Here are a few facts about consumers and credit:

6 Tips For a Better FICO Score

Median FICO Scores by State:

Above 728 712 - 727 691 - 711 656 - 691

CT CO AK AL

IA HI AR FL

MA ID AZ GA

MN IL CA LA

ND KS DC MS

NE MD DE NM

NH ME IN NV

RI MI KY OK

SD MO NC SC

VT MT TN TX

WI NJ WV

NY

OH

OR

PA

UT

VA

WA

WY

Your credit score is often referred to as your FICO score. It stands for Fair Isaac’s Corporation and isn’t really the only score out there – but for the sake of this article, we’ll refer to the FICO score. Here are a few facts about consumers and credit:

- The average consumer has a total of 13 credit obligations (including revolving, store cards, and installment loans). Of these obligations, 9 are likely to be credit cards.

- More than half of all people with credit cards are using less than 30% of their total credit card limit (total available line of credit on each card, on average, is $19,000). The higher the balances on your card (compared to available credit) the lower your credit score will go – even if you pay everything on time each month.

- The average oldest obligation is 14 years – that means someone is getting tons of interest from these people!.

- Fewer than 6% of the credit carrying population has 4 or more hard inquiries in a one year period. A hard inquiry is a credit check that shows up on your credit report as you seeking additional credit. A soft inquiry will only be reported to you (not creditors) when you pull your credit report. A lot of hard inquiries will lower your credit score.

6 Tips For a Better FICO Score

- Pay your bills on time. Sign up for automated payments if you have a hard time remembering to make payments.

- Keep your balances low on revolving credit. Under 35% will improve your FICO. Lenders use different percentages and their percentage is usually considered a trade secret. In general, 35% is the lowest they’ll use so just stay below that.

- Don’t open new accounts if you have ample credit. New accounts generally lower your score. Unless, of course, you’re just starting out. It can be difficult to attain credit if you haven’t established a credit file – so be sure you have at least a couple of major credit cards open.

- Close unused cards cautiously. The ratio of number of cards to amount owing can impact your FICO. Also, keep track of which is your oldest card and always try to keep that account open; even if you only make small purchases.

- If you’re making a large purchase, do your a.p.r. (i.e., interest rate) shopping within a short period of time (45 days was recommended). The FICO score sometimes compensates for rate shopping if the inquiries are all within a short amount of time.

- A new account with a recent late payment will hurt your credit score terribly. Don’t let this happen to you.

Median FICO Scores by State:

Above 728 712 - 727 691 - 711 656 - 691

CT CO AK AL

IA HI AR FL

MA ID AZ GA

MN IL CA LA

ND KS DC MS

NE MD DE NM

NH ME IN NV

RI MI KY OK

SD MO NC SC

VT MT TN TX

WI NJ WV

NY

OH

OR

PA

UT

VA

WA

WY

RSS Feed

RSS Feed